At-The-Market (ATM)

Why use an ATM Facility

Every growing business requires funding to accelerate operations. The key advantage of being a publicly listed organisation is the ability to raise funds through the capital markets.

An ATM facility with Dolphin Corporate Investments (DCI) can assist the company in raising funds promptly and cost effectively. There is no need for the company to discount their stock price or suspend trading to facilitate funding.

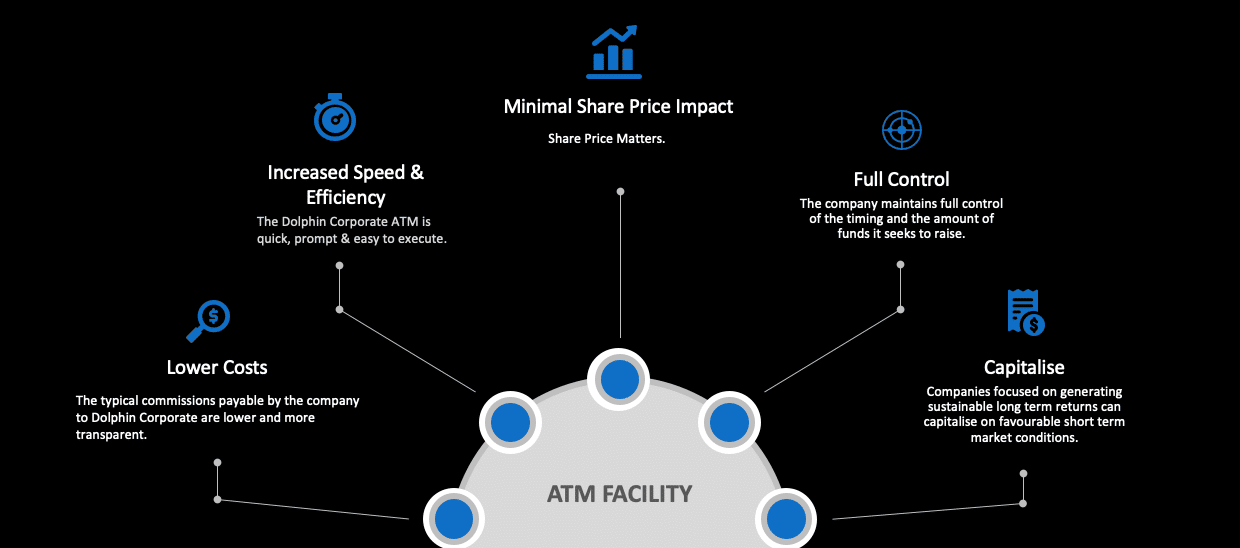

Lower Costs

The typical commissions payable by the company to Dolphin Corporate Investments (DCI) are lower and more transparent than the type of fee that would be associated with a traditional placement.

Increased Speed & Efficiency

An ATM facility can assist the company in raising funds promptly & cost effectively. There is no need for the company to discount their stock price or suspend trading to facilitate funding.

There is also a reduced dependency on investor roadshows and minimal management involvement. This provides senior management with more time to manage day-to-day operations and focus on strategic goals and objectives.

Full Control

The company also retains full control over decisions relating to:

- Timing

- Amount

- Selection

- Raise/Floor Price

Capitalise

- In 2020 Elon Musk’s Tesla corporation (TSLA.NASDAQ) raised US$5 Billion via an ATM offering (1% of their entire market cap).

- GameStop (GME.NYSE) was also an example of a company that utilised an ATM offering to sell their own shares and raise $1.13 billion in 2021, capitalising on favourable short term market conditions.

Every ASX listed company should consider an ATM facility, it is a valuable capital management tool when required.An ATM Facility enables a company to add to liquidity and in times of high speculation take advantage of volatility where speculators have distorted the fundamental picture.